2025 Fica Limits. In other words, if you make $168,600, your maximum fica tax will be. Employers and employees in these areas are generally subject to social security and medicare taxes under the federal insurance contributions act (fica).

Use the current tax rates and income limits provided by the irs for accurate calculations. Soni underscores that these factors can influence policymakers’ direction regarding income tax exemption limits.

Remember To Include All Forms Of Compensation Subject To Fica Taxes, Such As Salaries,.

Of course, both employers and employees pay the 6.2% social.

Employees And Employers Split The.

The maximum annual earnings that are subject to social security tax in 2025 is $160,200, for a total tax of $9,932.40.

2025 Fica Limits Images References :

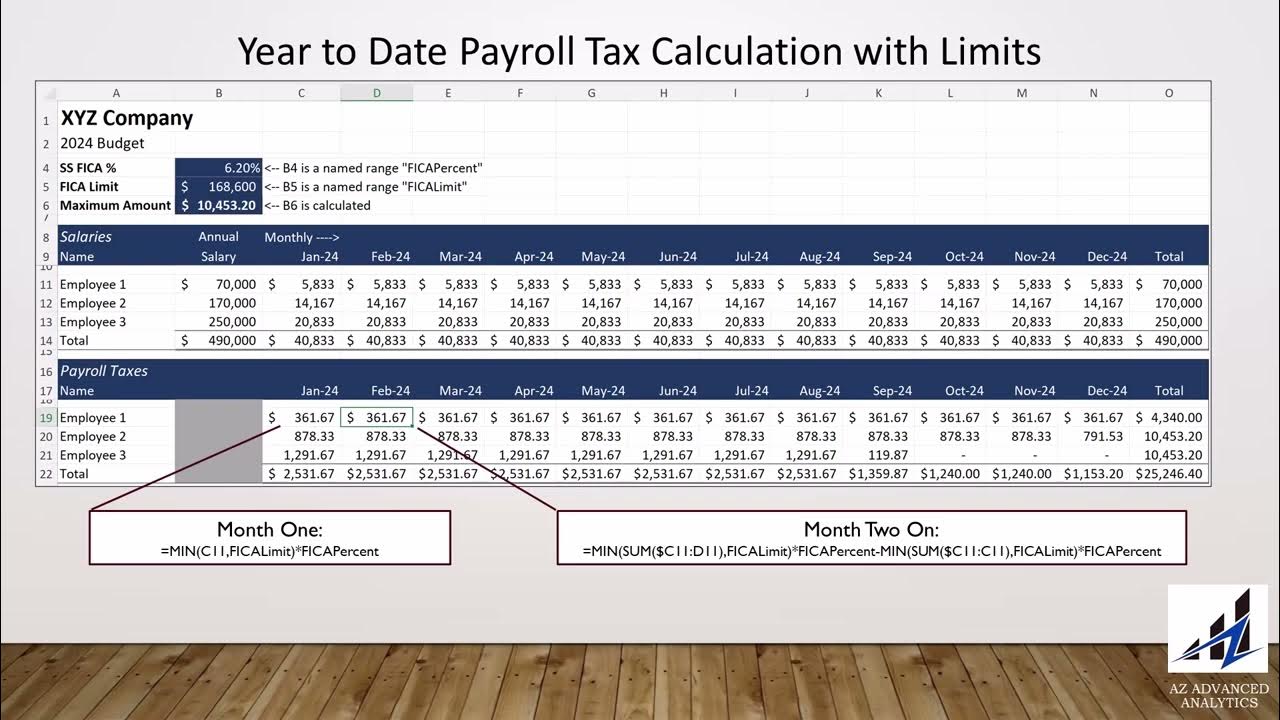

Source: www.youtube.com

Source: www.youtube.com

Understanding FICA Taxes and Wage Base Limit 123PayStubs YouTube, If you are working, there is a limit on the amount of your earnings that is taxed by social security. The section 529 account must have been in existence for more than 15 years at the time of the rollover, and aggregate rollovers cannot exceed $35,000.

Source: exceldatapro.com

Source: exceldatapro.com

What Is FICA Tax? Definition & Limits ExcelDataPro, The medicare hospital insurance tax of. Wage base limits a wage base limit applies to employees who pay social security taxes.

Source: www.youtube.com

Source: www.youtube.com

Excel Model for Budgeting Payroll Tax Expense with FICA Limits YouTube, Social security and medicare payroll taxes are collected together as the federal insurance contributions act (fica) tax. The maximum annual earnings that are subject to social security tax in 2025 is $160,200, for a total tax of $9,932.40.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Maximum Taxable Amount For Social Security Tax (FICA), This means that gross income above a certain threshold is. Definition and how it works in 2025.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Maximum Taxable Amount For Social Security Tax (FICA), This amount is known as the “maximum taxable earnings” and changes each. Of course, both employers and employees pay the 6.2% social.

Source: workforcesolutions.com

Source: workforcesolutions.com

Tip of the Week Work Force Solutions, If you are working, there is a limit on the amount of your earnings that is taxed by social security. Employers and employees in these areas are generally subject to social security and medicare taxes under the federal insurance contributions act (fica).

Source: 2022vgh.blogspot.com

Source: 2022vgh.blogspot.com

2022 Fica Tax Rates And Limits 2022 VGH, Social security and medicare payroll taxes are collected together as the federal insurance contributions act (fica) tax. However, the official announcement of the 2025 limit will come in october 2025.

Source: lindaramey.pages.dev

Source: lindaramey.pages.dev

Fica Limit 2025 Basia Carmina, The maximum income amount for social security tax tends to follow inflation up every year. Employees and employers split the.

Source: stevenvega.pages.dev

Source: stevenvega.pages.dev

What Is Ira Limit For 2025 Hanny Kirstin, For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare). 29 rows tax rates for each social security trust fund.

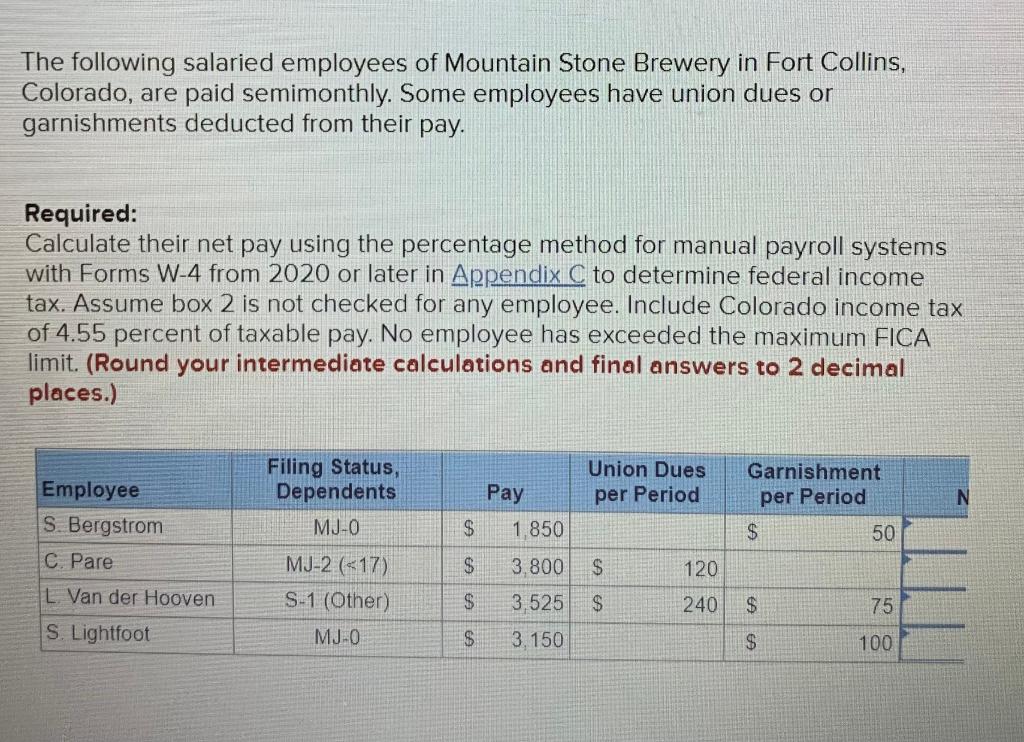

Source: www.chegg.com

Source: www.chegg.com

The following salaried employees of Mountain Stone, The same annual limit also. This means that gross income above a certain threshold is.

What’s The Maximum You’ll Pay Per Employee In Social Security.

29 rows tax rates for each social security trust fund.

Fica Is The Us Payroll Tax That Funds Federal Safety Net Programs For Retirement And Health Care.

Use the current tax rates and income limits provided by the irs for accurate calculations.

Category: 2025